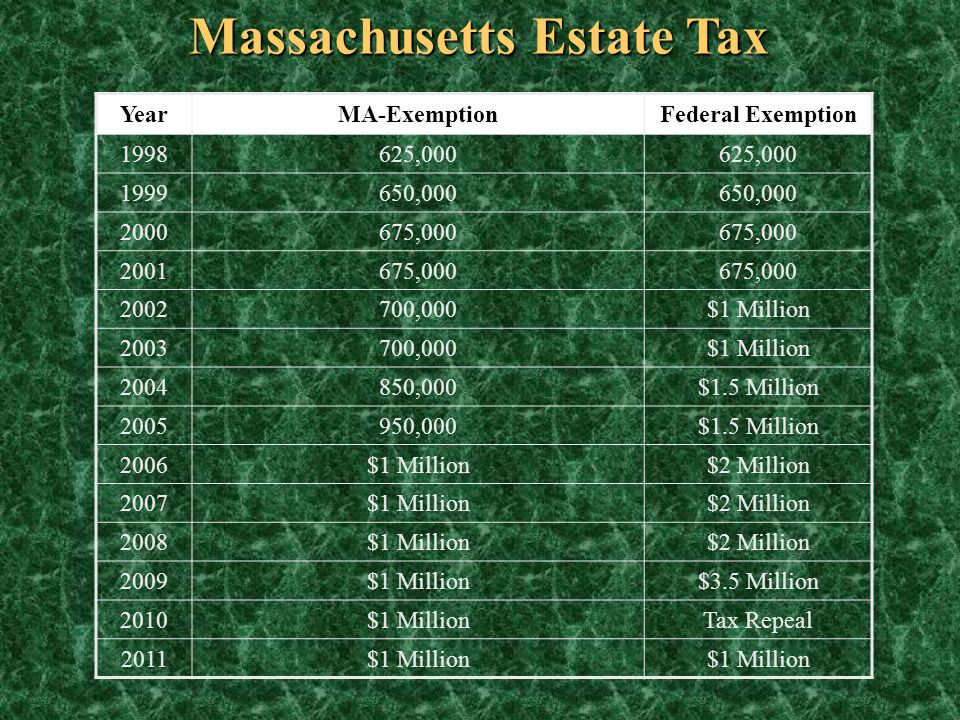

massachusetts estate tax rates table

Additionally because the taxable estate of. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000.

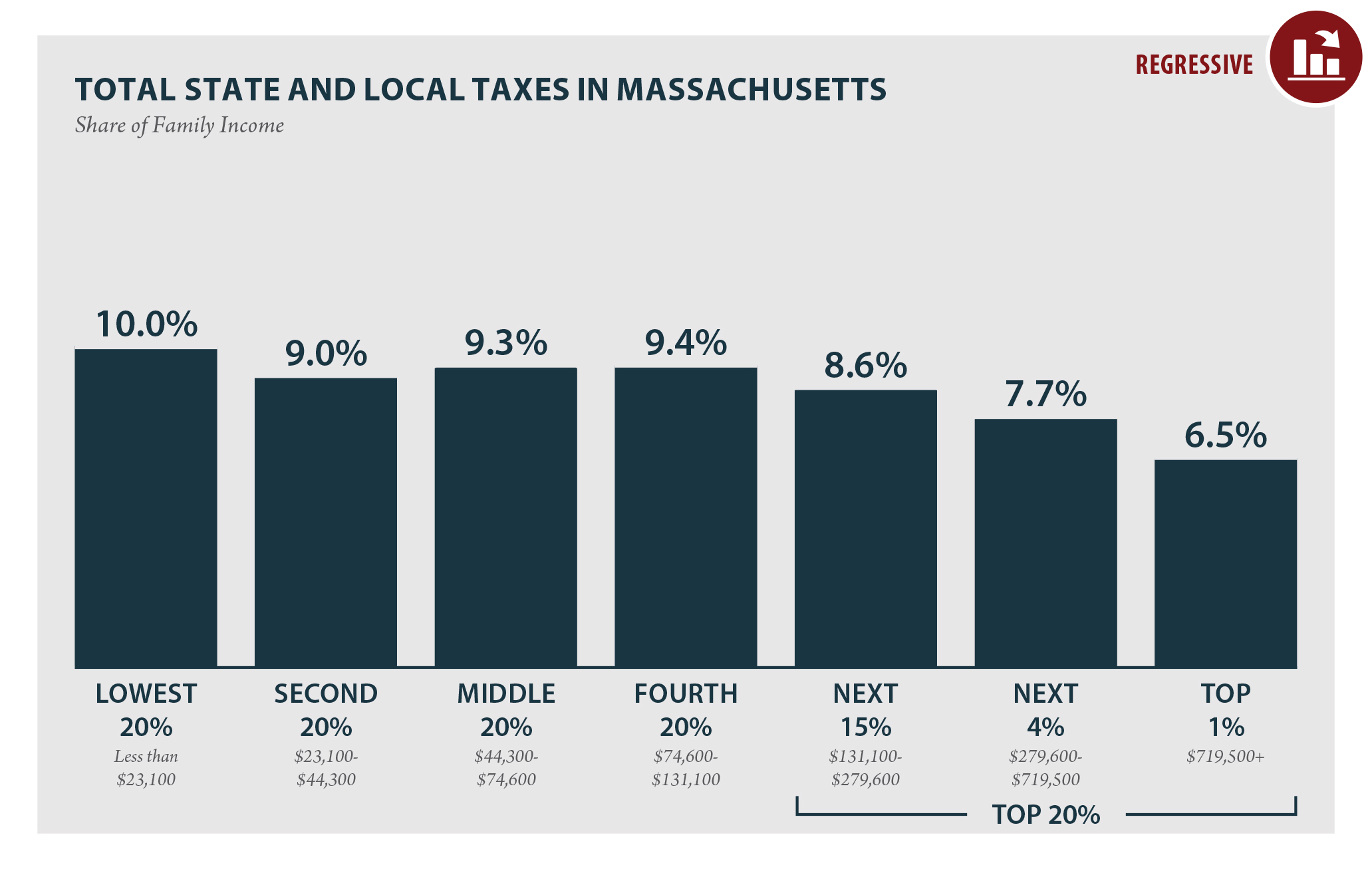

Ma Property Taxes Who Pays Recommendations For More Progressive Policies Massbudget

Generally Massachusetts is a high tax state and the average homeowner pays 114 of their home value every year in property taxes.

. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. Was enacted in 1975 and is applicable to all estates of decedents dying on or after January 1 1976. Take a look at the Massachusetts estate tax rates table below.

Compared to other states. Future changes to the federal estate tax law have no impact on the Massachusetts estate tax. July 13 2022 Massachusetts property real estate.

Future changes to the federal estate law will not affect the Massachusetts estate tax law as the reference for Massachusetts is the Code as in effect on December 31 2000. 104 of home value. A state sales tax.

But dont forget estate tax that is assessed at the state level. The Massachusetts estate tax law MGL. The Massachusetts estate tax for a resident decedent generally.

More details on estate taxes in Massachusetts are. 351 rows 2022 Massachusetts Property Tax Rates Click here for a map with additional tax rate information Last updated. The table below lists all of the.

A guide to estate taxes Mass. Chilmark has the lowest property tax rate in Massachusetts with a tax rate of 282 while Longmeadow has the highest property tax rate in Massachusetts with a tax rate of 2464. 2022 Massachusetts Property Tax Rates.

A local option for cities or towns. The estate rate tax depends on the size of the estate. Up to 25 cash back If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would.

This can be very confusing to tax and legal professionals in addition to. A local option for cities or towns. The Massachusetts estate tax is a transfer tax imposed on the value of all property in the estate of a decedent at the date of death and not on the value of property received by each beneficiary.

For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40. The filing threshold for 2022 is 12060000. A state excise tax.

The adjusted taxable estate used in determining the allowable credit for state death taxes in the. For estates of decedents dying in 2006 or after the applicable exclusion amount is 1000000. Tax amount varies by county.

Only to be used prior to the due. This adds up to 1138 for every 1000 in home. The Massachusetts estate tax is equal to the amount of the maximum credit for state death taxes.

Sales rate is in the top-20 lowest in the US. The state sales tax rate in massachusetts is 625 but you can customize this. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold.

625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Historical Massachusetts Tax Policy Information Ballotpedia

How Do State And Local Property Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

A Guide To Estate Taxes Mass Gov

Living Wills Health Care Proxies Ppt Download

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Massachusetts Lawmakers Push Back On Charlie Baker S Plan To Slash Short Term Capital Gains Taxes Double Estate Tax Threshold

3 Ways To Avoid Estate Taxes In Massachusetts

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

Massachusetts Estate And Gift Taxes Explained Wealth Management

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Massachusetts Who Pays 6th Edition Itep

Estate Tax In Massachusetts Slnlaw

Massachusetts Who Pays 6th Edition Itep

State Taxes On Inherited Wealth Center On Budget And Policy Priorities